How to Get Cash Before Your Next Payday?

Your Lifeline: How to Get Money Until Next Payday

We've all been there. That moment when the cash crunch hits hard – an unexpected car repair, a medical bill, or simply the gap before payday stretches a little too long. Staring at an empty wallet can feel overwhelming, but take a deep breath. You're not alone, and there *are* practical, strategic ways to bridge the gap and secure the quick cash you need. This guide explores actionable solutions and smart planning to navigate financial tight spots.

Facing the Financial Crunch Head-On

Before scrambling for solutions, pause for a crucial step: a financial health check. Ignoring the numbers only prolongs the stress.

Assessing Your Situation

Grab paper, a spreadsheet, or a budgeting app. Clearly list your current income sources, all essential expenses (rent, utilities, groceries, minimum debt payments), and any outstanding debts. This snapshot reveals exactly where you stand, highlighting immediate needs versus areas for potential adjustment. It’s the essential foundation for informed decision-making.

The Power of Proactive Budgeting

Think of your budget as your financial GPS. It doesn't just track spending; it guides you towards stability. Analyze your expense list critically. Where can you temporarily cut back? Dining out, subscription services, and entertainment are common areas offering quick savings. Every dollar redirected is a dollar earned towards your immediate goal.

Building Your Financial Shock Absorber: The Emergency Fund

While it might not solve today's problem instantly, building an emergency fund is your best defense against *future* financial surprises.

Why It Matters

An emergency fund acts as a dedicated safety net for unforeseen expenses, preventing the need for high-cost borrowing later. It provides invaluable peace of mind.

How to Start (Even Now)

Aiming for 3-6 months of living expenses is ideal, but start where you are. Open a separate savings account. Commit to automatically transferring *any* amount – $10, $20, $50 – from each paycheck. Treat it as a non-negotiable bill. Seeing it grow, even slowly, builds confidence and resilience.

Urgent Cash Solutions: How to Get Money Until Next Payday

When you need funds *now*, explore these reliable avenues:

1. Leveraging Your Skills: The Gig Economy Boom

Your talents can be your fastest route to cash. The gig economy offers immense flexibility:

Platform Power

Sign up on sites like Upwork, Fiverr, or Freelancer. Offer services you excel at: writing, editing, graphic design, social media management, virtual assistance, data entry, or even tutoring.

Local Gigs & Quick Tasks

Check apps like TaskRabbit for local handyman jobs, furniture assembly, or moving help. Pet sitting (Rover, Wag!) or ride-sharing (Uber, Lyft) are also viable options depending on your location and resources.

Key Tip: Focus on projects with quick turnaround times. Even dedicating a few focused evenings can yield significant extra cash.

2. Turning Clutter into Cash: Sell What You Don't Need

Your home is likely a treasure trove of unused items ready for conversion into emergency funds.

Digital Marketplaces

eBay is great for niche items, collectibles, and electronics. Facebook Marketplace excels for local sales of furniture, clothing, appliances, and tools. Craigslist remains a solid option for larger items.

Specialized Apps

Use Poshmark or Depop for clothing and accessories. Sell old tech quickly via Gazelle or Decluttr. Books? Try BookScouter or local used bookstores.

Key Tip: Take clear photos, write honest descriptions, price competitively, and be responsive. Decluttering feels great and funds your needs!

3. Understanding Payday Advances & Short-Term Loans

These options exist but require extreme caution and should be a *last resort*.

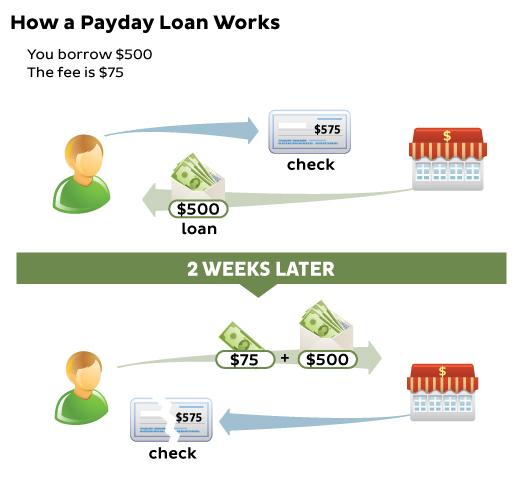

How They Work

Payday advances offer small sums (usually a few hundred dollars) to be repaid, plus significant fees, on your next payday. Some installment loans offer slightly longer terms.

The Critical Caveat

APRs (Annual Percentage Rates) can be astronomically high, sometimes exceeding 400%. This makes repayment difficult, often trapping borrowers in a cycle of debt. Only consider this if you are ABSOLUTELY CERTAIN you can repay the FULL amount plus fees on the due date. Exhaust all other options first.

4. Seeking Support: Community & Assistance Programs

Don't underestimate the power of reaching out. Support comes in many forms:

Personal Network

Approach trusted friends or family. Be clear about your need, propose a realistic repayment plan, and treat it as a formal agreement. A small, interest-free loan can be immensely helpful.

Community Resources

Research local non-profits, charities, and religious organizations. Many offer assistance with utilities (LIHEAP), rent, food pantries, or even emergency grants.

Government Aid

Check eligibility for programs like SNAP (food stamps), TANF (Temporary Assistance for Needy Families), or local emergency assistance initiatives. Your state or county social services website is the best starting point.

5. Credit Unions & Community Banks: A Potential Alternative

If you need a small loan, consider these institutions. Credit unions, in particular, are member-owned and often offer:

Better Terms

Potentially lower interest rates and more flexible repayment options on small personal loans compared to payday lenders.

Financial Counseling

Many provide free financial advice to help members manage their situations.

Key Tip: Building a relationship with a local credit union *before* an emergency hits is advantageous.

Beyond the Crunch: Building Lasting Stability

Surviving this payday gap is crucial, but use it as motivation for a stronger financial future.

- Refine Your Budget: Make budgeting a consistent habit. Track diligently.

- Prioritize Your Emergency Fund: Keep contributing, no matter how small.

- Explore Sustainable Side Hustles: Can that gig become a more regular income stream?

- Review Spending Habits: Identify ongoing leaks and plug them.

Financial stability is a continuous journey. Each step you take – whether weathering a short-term storm or building your savings – strengthens your position. Take control today, implement these strategies, and pave the way for a more secure and confident financial future.

Source

No comments