Revenue After Expenses

Unlocking Profit: A Comprehensive Guide to Boosting Your Bottom Line

Ever wondered how successful businesses thrive? At its core, it all boils down to understanding and maximizing profit. Forget complex financial jargon; let's break down the concept with a relatable example. Imagine running a bustling coffee shop. You sell each cup for $3 and, after a busy morning, rake in $300. Fantastic! But hold on – you had to buy coffee beans, milk, sugar, and those eco-friendly cups. These expenses totaled $120. What's left after deducting those costs? That's your profit – in this case, a healthy $180. But how do we calculate this accurately, and why is it so vital for your business's survival and growth? Let's dive in.

Profit: The Lifeblood of Your Business

Profit is the oxygen that keeps your business alive. Simply put, it's the money you earn after subtracting all your expenses. Think of it as the reward for your hard work and investment. Understanding how to calculate profit is the cornerstone of sound financial management. This figure will largely determine success from failure and needs to be paid special attention to.

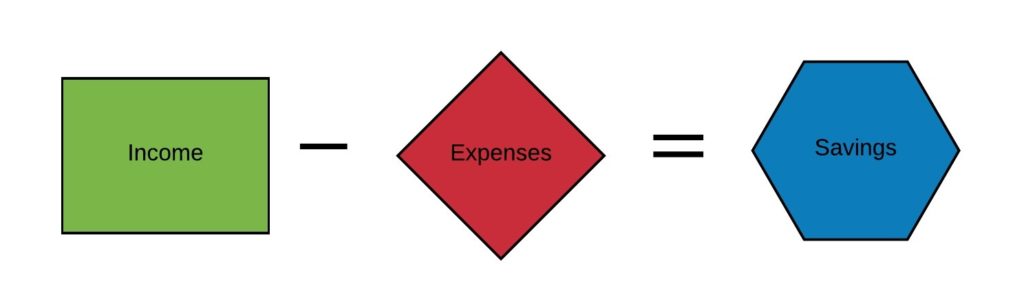

Calculating Profit: The Formula for Success

The basic formula is straightforward: Total Revenue - Total Expenses = Profit. Revenue reflects how well the sales perform and expenses reflect how wisely the finances are spent. This calculation is central to your income statement, a vital document that provides a snapshot of your business's financial performance over a specific period.

Revenue: Fueling Your Profit Engine

Revenue represents the total income your business generates from sales of goods or services. It's the "top line" on your income statement. Without revenue, there's no possibility of making a profit. Here are strategies.

- Boost Sales Volume: Attract more customers through marketing, promotions, or improved customer service.

- Strategic Pricing: Consider raising prices, but be mindful of market conditions and competition. Value is the most important thing.

Maximizing Revenue: Finding the Sweet Spot

While increasing prices can boost revenue, it's crucial to avoid pricing yourself out of the market. Conduct thorough market research to understand customer price sensitivity and adjust accordingly.

Expenses: Managing Your Outgoings

Expenses are the costs associated with running your business – rent, utilities, salaries, raw materials, marketing, and a plethora of other financial considerations. They appear on the "bottom line" of your income statement. Expenses will always be around, they are a constant. However, it is how the finances are managed that counts.

- Negotiate with Suppliers: Explore discounts or alternative suppliers to reduce material costs.

- Energy Efficiency: Reduce utility bills by implementing energy-saving measures.

- Streamline Processes: Identify and eliminate wasteful practices to improve efficiency.

The Pitfalls of Cutting Costs Too Deeply

While minimizing expenses is crucial, avoid compromising the quality of your products or services. Cutting corners can lead to customer dissatisfaction and ultimately hurt your bottom line.

Why Accurate Profit Calculation Matters

Accurate profit calculation provides vital insights into your business's financial health. It reveals whether your business is thriving, stagnant, or in trouble. This information empowers you to make informed decisions about key aspects of your business.

- Expansion Strategies: Assess whether current profit margins justify expansion.

- Staffing Decisions: Determine if you can afford to hire additional staff.

- Investment Opportunities: Evaluate the potential return on investment for new equipment or technology.

By understanding your profit, you can set realistic financial goals and develop a robust financial plan that ensures long-term sustainability.

Profit vs. Cash Flow: Understanding the Difference

Profit and cash flow are different but related. Think of profit as the scorecard and cash flow as the actual money in your bank account. A business can be profitable on paper but struggle with cash flow if customers don't pay on time. Managing both is essential for financial stability.

Managing Cash Flow: Keeping the Money Moving

Focusing on cash flow will reduce the stress and the possibility of running the business to the ground and bankrupt.

- Offer incentives for early payments.

- Negotiate favorable payment terms with suppliers.

- Carefully manage inventory levels to minimize holding costs.

Financial Management: The Key to Profit Maximization

Effective financial management involves planning, organizing, directing, and controlling your financial activities. It's about making smart, informed decisions with your money.

- Budgeting: Create a detailed budget to track income and expenses.

- Financial Analysis: Regularly analyze your financial statements to identify trends and opportunities.

- Risk Management: Implement strategies to mitigate financial risks.

By mastering these principles, you can unlock your business's full profit potential and pave the way for long-term success.

Every dollar counts. Every expense matters. And every decision you make impacts your profit. Be smart. Be strategic. Always keep an eye on your bottom line.

Source![]()

No comments